Insights > Client Alerts

Client Alerts

CARF Bill sanctioned with substantial cuts

September 22nd, 2023

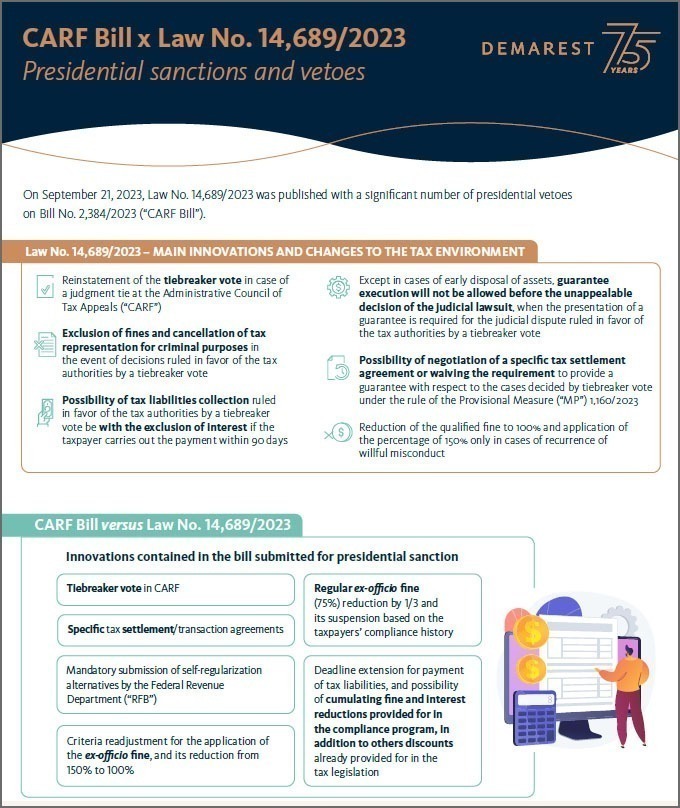

CLICK HERE OR THE IMAGE BELOW TO VIEW THE FULL INFOGRAPHIC ABOUT THIS TOPIC

On September 21, 2023, following the approval of Bill No. 2,384/2023 (“CARF Bill”) by the House of Representatives and the Brazilian Federal Senate, Law No. 14,689/2023 was published with a significant number of presidential vetoes.

In general, the innovations and changes to the tax environment introduced by the Law are as follows:

- Reinstatement of the tiebreaker vote in case of a judgment tie at the Administrative Council of Tax Appeals (“CARF”).

- Exclusion of fines and cancellation of tax representation for criminal purposes in the event of decisions ruled in favor of the tax authorities by a tiebreaker vote.

- Possibility of tax liabilities collection ruled in favor of the tax authorities by a tiebreaker vote be with the exclusion of interest if the taxpayer carries out the payment within 90 days. These payments can be carried out in cash, in up to 12 months or using credits from tax losses and negative calculation basis of the Social Contribution on Net Income (“CSLL”).

- Except in cases of early disposal of assets, guarantee execution will not be allowed before the unappealable decision of the judicial lawsuit, when the presentation of a guarantee is required for the judicial dispute ruled in favor of the tax authorities by a tiebreaker vote.

- Possibility of negotiation of a specific tax settlement agreement or waiving the requirement to provide a guarantee with respect to the cases decided by tiebreaker vote under the rule of the Provisional Measure (“MP”) 1,160/2023

- Reduction of the qualified fine to 100% and application of the percentage of 150% only in cases of recurrence of willful misconduct.

In addition to reinstating the tiebreaker vote in CARF, the CARF Bill also provided for the possibility of:

- tax settlement/transaction agreements

- regular ex-officio fine (75%) reduction by 1/3 and its suspension based on the taxpayers’ compliance history

- criteria readjustment for the application of the ex-officio fine, and its reduction from 150% to 100%

- deadline extension for payment of tax credits and possibility of cumulating fine and interest reductions provided for in the compliance program, in addition to others discounts already provided for in the tax legislation

- mandatory submission of self-regularization alternatives by the Federal Revenue Department (“RFB”)

After the text was analyzed and approved by the House of Representatives and the Brazilian Federal Senate, the CARF Bill was forwarded to the President of Brazil, who partially approved it and rejected 15 of the Bill’s topics on the grounds that they were unconstitutional (legal vetoes) or contrary to the public interest (political vetoes).

Among the President’s vetoes are topics such as the reduction/forgiveness of penalties, the regulation of specific tax settlement/transaction, the RFB’s obligation to provide for self-regularization methods and the possibility of cooperatives having legal entities or Companies as members.

REDUCTION OF PENALTIES

In addition to the veto of various tax compliance incentive provisions, Law No. 14,689/2023 did not include the possibility of reducing the ex-officio fine (75%) by at least 1/3 or the penalty of late payment (20%) by half, on the grounds that no guidelines had been established for the operationalization of these reductions.

The final text of Law No. 14,689/2023 did not incorporate the possibility of a 1/3 reduction in the regular ex-officio fine of 75% in the event of an excusable error by the taxpayer that demonstrates due diligence in complying with the tax obligation, a diverging interpretation of the legislation or repeated practices adopted by the administration or the market segment.

The President also vetoed the provisions that provided for the possibility of forgiving the ex-officio fine according to the taxpayer’s compliance history, and that ended the imposition of an aggravated fine for obstructing inspection.

CANCELLATION OF PENALTIES GREATER THAN 100% OF THE TAX LIABILITY

Law No. 14,689/2023 was published without the provision that allowed for the possibility of canceling all fines that exceed 100% of the assessed tax liability, on the grounds that adopting this measure would have negative implications in terms of the financial and budgetary, and it would generate a significant administrative and judicial burden.

GRADATION OF EX-OFFICIO FINES

The President of Brazil vetoed an article that provided for a single fine in cases of tax evasion, fraud or collusion. The provision that allowed for the possibility of waiving the ex-officio fine in cases where the taxpayer sought to remedy the actions or omissions typified as evasion, fraud or collusion during the course of the inspection was also vetoed, on the grounds that the provision would violate the rule in the Brazilian Tax Code on voluntary disclosure, and “could reduce the deterrent power of the qualified fine“.

MEDIATION/CONCILIATION AND TAX TRANSACTIONS

The text submitted to the President provided for the possibility of disputes between taxpayers and the RFB caused by legal divergences between the tax authority and the regulatory body submitted to the Mediation and Conciliation Chamber of the Federal Public Administration. This provision, however, was vetoed by the President on the grounds that there is no scope for mediation/conciliation in the administrative process regarding a possible divergence in the tax classification of goods since the tax administration has exclusive authority to rule on the matter.

Regarding tax transactions, the CARF Bill provided for the possibility that liabilities ruled in favor of the tax authorities by tiebreaker vote could be subject to a tax transaction, which must be regulated by the Attorney-General of the National Treasury and contain conditions “no less favorable” than those offered to other taxpayers. This specific provision was vetoed on the grounds that it violated the principle of equality since no standards had been established for determining these transaction conditions.

INSURANCE BOND AND BANK GUARANTEE

Amendments to the Tax Foreclosures Law (Law No. 6,380/1980) were also vetoed, in relation to the set of provisions relating to insurance bonds and bank guarantees, since the CARF Bill provided for the possibility of these instruments being used to guarantee only the principal of debts and would not include the so-called ancillary costs (interest, fines and charges). The President understood that this provision would imply the impossibility of immediate execution of these types of guarantee and could weaken the collection process.

Finally, it is important to highlight that there is a constitutional provision for the National Congress representatives and senators to deliberate on presidential vetoes within 30 days of the President’s message containing the vetoes and their respective reasons for joint deliberation. Calling a joint deliberation session is up to the president of the Brazilian Federal Senate and an absolute majority of the votes cast by representatives (257) and senators (41) is required for a veto to be rejected.

Find out more on the text forwarded for presidential sanction/veto, by accessing our infographic and client alert on the subject.

Demarest’s Tax team is monitoring this topic and is available to provide any further clarifications that may be necessary.