Insights > Newsletters

Newsletters

Investment Funds and Structured Finance Newsletter – August 2024

September 12th, 2024

The Investment Funds and Structured Finance Newsletter provides information on the main administrative acts, rules, and legal texts regarding the regulation of investment funds, asset management, and structured operations.

This material is for informative purposes only, and should not be used for decision-making. Specific legal advice can be provided by our legal team.

The English issue of the Investment Funds and Structured Finance Newsletter is a summarized version of the Portuguese issue, in which we highlight the most important news to our international clients. If you want to access a specific article that was not translated into the English version, please contact us.

CVM publishes regulations on the portability of capital market investments

On August 26, 2024, the Securities and Exchange Commission (“CVM”) published CVM Resolution No. 210 (“CVM Resolution 210”), which establishes the regulations and procedures for the portability of investments in securities, and CVM Resolution No. 209, which provides for specific changes in other regulations, as a supplement to CVM Resolution 210. Both regulations represent the initial milestone towards improving user experience through the portability of investments in securities.

We highlight the following amendments as follows:

- Application for virtual portability – physical forms and registry office notarizations are not needed.

- Investors can choose whether portability will be carried out at the origin, destination or with a central depository.

- Transparency regarding the estimated deadlines for completion of the portability process.

- Investors can monitor portability progress in real-time.

- Scheduling deadlines for portability completion, given the operational complexity of each group of securities.

- Provision of quantitative data on portability to the CVM and regulatory entities, allowing them to identify institutions that repeatedly delay portability completion or with a high rejection rate for portability applications.

- The systematic failure to comply with the deadlines established for portability completion or the unjustified withholding of portability processing will be considered a severe infringement.

In addition to the changes mentioned above, it is worth highlighting those that were submitted to public consultation, opened on October 03, 2023, such as:

- Replacing the three separate stages (preliminary and supplementary diligence and completion) with a single phase, encompassing the steps to identify and overcome hindrances and complete the portability process.

- Assistance from custodians or destination intermediaries to investors when carrying out the portability.

- Possibility to apply for portability through a physical form.

- Central depositories and bookkeepers will not be required to act on the unit and purchase prices of deposited and book-entry securities, respectively. In addition, the duty to store and submit background information will fall solely on the originating custodian or intermediary.

- Transfers involving a change of ownership will not be governed by these portability regulations.

- Registrars will be entitled to receive portability applications, provided that the regulations applicable to central depositories are observed.

- The portability of derivatives will be restricted to contracts involving a central guarantor counterparty.

- The portability regulation will not govern transfers between central depositories or registrars. However, the matter could be revisited once the interoperability between central depositories and registrars is addressed in the Brazilian capital market.

For more information, access the client alert prepared by Demarest’s Capital Markets team.

For more information, access CVM’s article in full.

Change in the collection of registration fees for financial funds

On October 01, 2024, the Brazilian Financial and Capital Markets Association (“ANBIMA”) will adopt a new collection method in order to register investment funds.

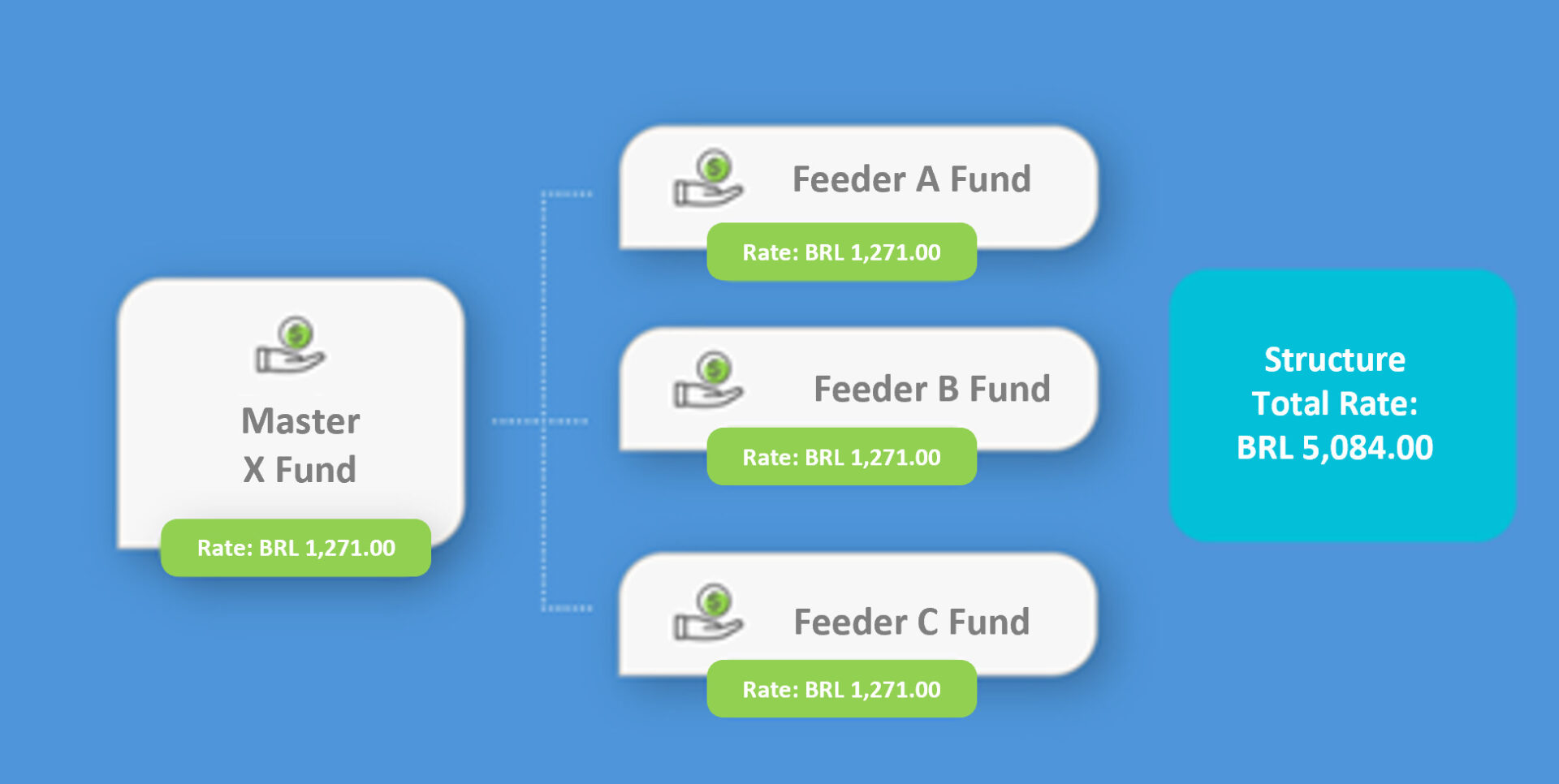

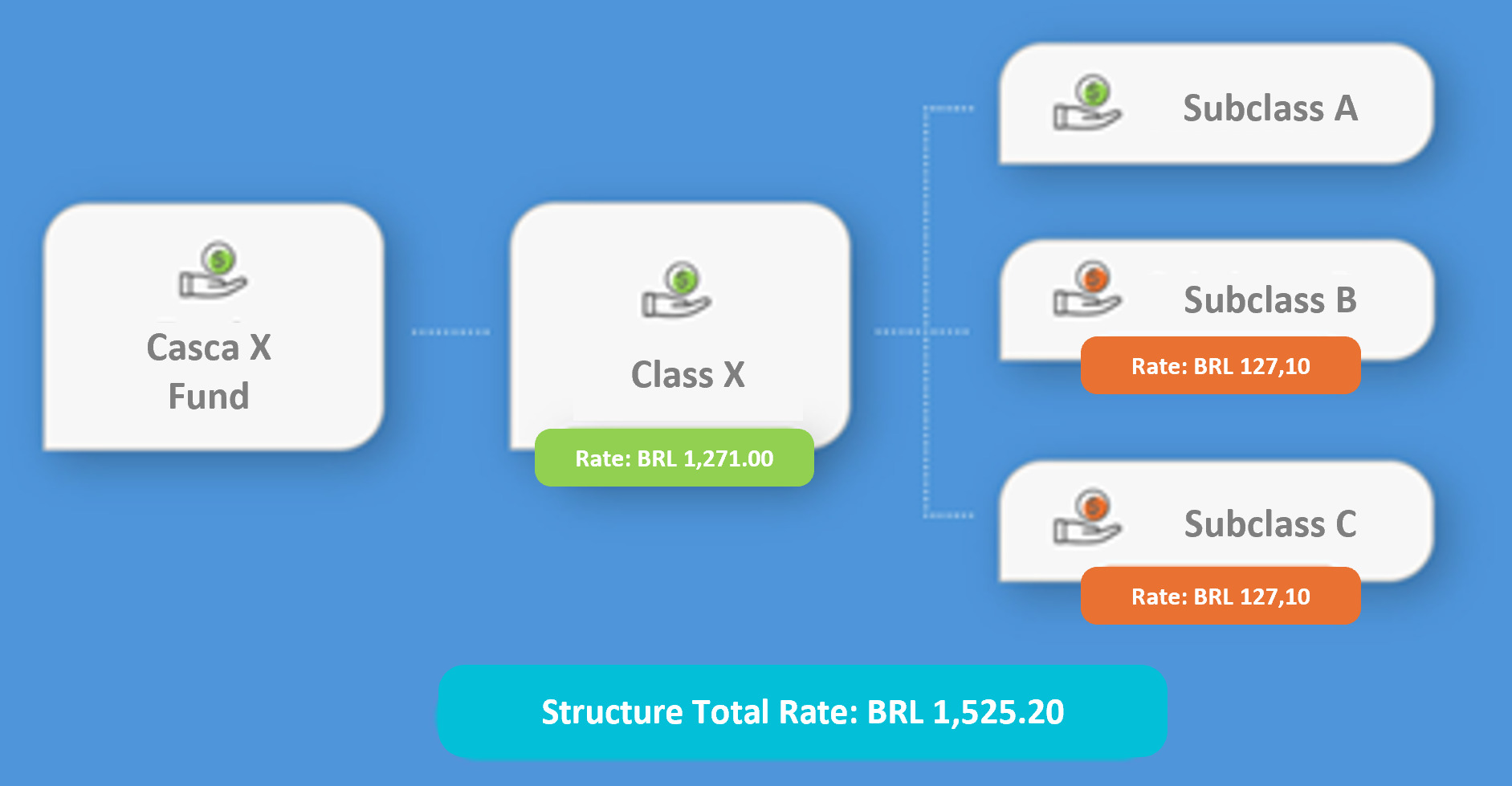

The fund’s class registration remains unchanged at BRL 1,271.00. The amount of BRL 127.10 per subclass will only be charged from the second registered subclass onwards. In other words, the total amount mentioned must only be paid for a fund’s class registration – 10% of which for each subclass registration – starting from the second subclass. With this change, ANBIMA seeks to mitigate the impact on the market by up to 70% compared to the current costs, as shown below:

|

|

| Current structure | Structure from October 01, 2024 |

For more information, access ANBIMA’s article in full.

CVM makes specific changes to Resolutions No. 47, No. 80, No. 160, No. 161

On August 13, 2024, the CVM amended Resolutions No. 207 and No. 208 (“CVM Resolution 207” and “CVM Resolution 208”) to change some specific CVM regulations, currently in force, to address the collection of fines for delayed submission of information and the standardization of restrictions applicable to secondary market trading of specific securities acquired through public offerings for distribution.

CVM Resolution 207 amended:

- Annex A to CVM Resolution No. 47, of August 31, 2021, to: (a) include coordinators of public offerings among agents subject to injunctive fines, establishing daily fines for delaying the submission of the reference form; and (b) align the annex mentioned above with the changes to CVM Resolution No. 175, of December 23, 2023.

- Article 63 of CVM Resolution No. 80, of March 29, 2022, which provides for injunctions arising from the failure to comply with deadlines in submitting periodic information, to provide for the possibility of imposing fines due to the delay in providing any information.

- CVM Resolution No. 161, of July 13, 2022, to: (a) include Art. 22-A, which expressly provides for the possibility of applying daily fines to coordinators that fail to meet the deadlines for submitting periodic information; and (b) clarify the deadline for submitting the report for the calendar year immediately preceding the date of submission of the conclusions of the examinations carried out, and the expected date for submitting the report to the Superintendence of Securities Registration (“SRE”).

CVM Resolution 208 amended:

- CVM Resolution No. 160, of July 13, 2022, to (a) standardize the trading restrictions applicable to the resale of debentures and securities; (b) include an explicit reference to subsequent Level III sponsored BDR offerings in Article 28, regarding the registration method for distributing securities; and (c) rectify the references to Article 26, VII, with an explicit reference to paragraphs “c” and “d”, through Article 87, regarding the exceptions to trading restrictions. According to the amendment, the offering can be made automatically if it is a subsequent distribution of non-exclusive closed investment fund quotas intended for general investors, provided that: (1) there has been a previous offering subject to prior analysis by the CVM, or (2) the application for registration has been previously analyzed by a self-regulatory entity authorized by the CVM.

For more information, access CVM Resolution 207 and the CVM article.

Transparency regulations on product distribution remuneration set for public hearing

On August 22, 2024, ANBIMA opened a public hearing to standardize the method to be used by institutions to outline and publish remunerations earned for trading investment services and products, seeking to align the Investment Products Distribution Code and the Financial Instruments Negotiation Code with CVM Resolution No. 179, of February 14, 2023. The resolution provides for remuneration transparency involving the trading of products and the conflicts of interest arising from this relationship. These changes will enter into force on November 01, 2024.

Amendments to the Investment Products Distribution Code:

In order to instruct investors regarding distributors’ remuneration upon investment, the institutions must keep quantitative information on remuneration involving securities trading in the logged-in section of their websites. For example, if investors are contacted by telephone, the institutions must submit the report within three business days.

Institutions must also provide investors with a statement including such information. The document for November and December 2024 must be submitted in January 2025, and the subsequent ones must be provided quarterly.

Fund investors must be informed of the effective rate and estimated variable distribution rate upon contracting. A notice must be attached to such information informing that such estimate can vary and, thus, differ from the quarterly statement, in compliance with the existing trading agreements executed between the distributor and the fund manager.

Finally, the resolution suggests that the code should mandate the disclosure of cross-border intermediation service remunerations to investors.

Amendments to the Financial Instruments Negotiation Code:

The proposed changes to the Financial Instruments Negotiation Code seek to assist institutions in outlining the remuneration earned through distributing certain products, such as the Guaranteed Real Estate Note and the Financial Note, distributed publicly, as well as the Structured Operations Certificate. This is due to the fact that certain operations have a complex structure, which leads to difficulties in defining clear remuneration parameters.

The proposal is that institutions be forced to keep a document, which will be supervised by ANBIMA, describing the procedures adopted to monitor remuneration. In addition, in order to standardize remuneration, minimum requirements have also been outlined, which will be applied to each specific product.

For more information, access ANBIMA’s article.

CVM convicts defendants for violating the duty of diligence in acquiring assets by investment funds

On July 09, 2024, the CVM’s Collegiate Board judged two related administrative sanctioning proceedings (“PAS”), filed by the Superintendence of Institutional Investors Oversight (“SIN”), to investigate an alleged breach – by a particular fund manager and its partner – of the duty of diligence in acquiring Bank Credit Notes issued by two different corporations (“CCB1” and “CCB2”).

SIN reported the following facts, which indicate the managing company’s lack of diligence with regard to the CCB1:

- transactions were carried out between related parties – considering that a director of one of the CCB issuers was a partner in the managing company;

- non-compliance with the funds’ regulations – assets were acquired in breach of the minimum credit assessment required; and

- flaws verified in the formalization and content of the guarantees backing the operations – given that the value of the real estate property sold in trust only reached the amount it did so that the manager could submit a sufficient guarantee to justify such operation.

The fund and its partner submitted a joint settlement agreement, which the CVM’s Collegiate Board accepted on February 18, 2021.

As for the lack of diligence regarding the CCB2, SIN questioned the legitimacy of the credit analysis report due to indications that the document had not been drafted before the asset acquisition – as it should. According to SIN, the report: (i) has a single page, which is not dated and bears no signatures; (ii) was submitted to the CVM’s supervision, by the managing company, when asked if it had been drafted after the acquisition of the CCB2; (iii) was not included in the checklist of documents.

In addition, another argument raised by SIN involved the monitoring report of the CCB2, drafted by the operation’s trust agent, which shows that: (i) both CCB2 guarantors had a history of financial debts; (ii) the issuer’s registration records showed more than BRL 3 million in refinancing, motions, and overdue debts shortly after the CCB2 issuance; (iii) shortly after the CCB2 issuance, the registration records of its partners was settled by eliminating debts amounting to approximately BRL 1.5 million; (iv) no other investor decided to join the CCB2 issuance.

Finally, with regard to the guarantees (credits from the company’s sales, funds, and financial investments), SIN claimed that they had become ineffective, given that the rating report indicated the following: (i) the purpose of the CCB2 was to settle short-term debts in order to improve the company’s financial condition; (ii) the graphs in the rating report revealed a significant drop in the company’s net profit.

In view of these facts, the CVM’s Collegiate Board considered that the fund manager breached its duty of diligence by causing the funds managed to acquire assets with a higher degree of risk than that permitted by the respective regulations. With regard to the CCB2, the Collegiate Board decided that the conduct was even more severe, as it involved accepting guarantees that fell short of those provided for in the regulations.

Thus, in relation to the first PAS, the manager was sentenced to pay a minimum penalty of BRL 240,000, including a 15% mitigating circumstance due to its good standing. Thus, the final amount was BRL 204,000. As for the partner, the penalty applied amounted to BRL 102,000. With regard to the second PAS, the managing company was sentenced to pay a minimum penalty of BRL 300,000 without any mitigating circumstances. Thus, the partner’s penalty was established at BRL 150,000.

For more information, access the report and vote of the reporting officer, João Accioly.