This newsletter is for informative purposes only and does not constitute legal advice for any specific operation or business. For more information, please contact our legal team.

In order to keep our clients informed about the current landscape of the main energy and natural resources sectors in Brazil, we have prepared the Energy Newsletter, a monthly bulletin with the main news of the energy market.

This information channel is the result of the collaboration between our “Oil & Gas” and “Energy” teams.

The newsletter was designed within the context of the energy transition that is being targeted in Brazil, and drafted as a complete source of information about the dynamic Brazilian energy market within the oil, natural gas, electricity and renewable energy sectors.

Enjoy reading!

Oil and Gas

HIGHLIGHTS

Increase in Brazil’s oil and gas production in May 2024

On July 02, 2024, the Brazilian National Agency for Petroleum, Natural Gas and Biofuels (“ANP”) published the Monthly Newsletter of Oil and Natural Gas Production for May 2024, which indicates an increase in oil, natural gas, and pre-salt production in the mentioned period. The overall production, which includes oil and natural gas, accounted for 4.234 million barrels of oil equivalent per day (boe/d). Regarding oil, 3.318 million barrels per day (bbl/d) were extracted – representing an increase of 3.9% compared to the previous month, and 3.6% compared to May 2023.

In turn, natural gas production in May 2024 accounted for 145.63 million cubic meters per day (m³/d). There was a 6.6% increase in burning compared to April 2024 and 0.8% compared to May 2023. The Pre-salt total production (oil + natural gas) for May reached 3.314 million boe/d, corresponding to 78.3% of the Brazilian production.

Brazil sets record for oil exports in 2024

On July 22, 2024, it was announced that Brazil set a new milestone in oil exports, considering the ANP’s historical series, which began in 2000. According to reports, 297.8 million barrels were sold in the foreign market from May to January, corresponding to 1.9 million barrels per day (bpd). In the same 2023 period, the daily trade accounted for 1.5 million barrels.

The accumulated increase in the first five months of 2024 totals 32.5%. According to Mahatma Ramos, technical director of the Institute for Strategic Studies of Petroleum, Natural Gas and Biofuels (“INEEP”), approximately one-third of this total volume is exported by Petrobras, and foreign oil companies sell the other two-thirds. Petrobras alone exported approximately 650 bpd in the first quarter of 2024, of which 46% was exported to China and only 7% to the United States.

ANP approves new resolution on compressed natural gas in bulk

On July 25, 2024, the ANP’s Board approved a new resolution regulating the packaging and handling activities of compressed natural gas (“GNC”) in bulk by alternative modes to pipelines (such as roads). The new resolution will substitute in full ANP Resolution No. 41/2007.

As informed by the ANP, the new resolution sought to simplify the authorizing process as well as align the regulations to the terms and concepts of the New Gas Law (Law No. 14,134/2021). The resolution also introduces intermodal transport alternatives as a possibility for developing GNC processes while concentrating the technical requirements for GNC facilities in a single instrument, in addition to referring the trade of compressed natural gas to ANP Resolution No. 52/2011, which already disciplines this matter.

The incentive to distribute bulk GNC contributes to developing new natural gas consumer markets, especially in areas with difficult access to pipeline infrastructure.

Recently, the ANP also published ANP Resolution No. 971/2024, regulating the activities of packaging and handling liquefied natural gas (LNG) in bulk by alternative modes to pipelines.

NEWS

Offshore oil production increases by 12% in 2023

On July 01, 2024, Brazil Energia reported that offshore oil production increased by 12% in 2023, reaching 3.32 million bpd, compared to 2.94 million bpd in 2022.

The figures are included in the 2024 Brazilian Statistical Yearbook of Oil, Natural Gas, and Biofuels, published by the ANP. Offshore oil production has risen since 2021, reaching 2.82 million bpd. Conversely, the onshore oil production reached 0.08 million bpd in 2023, which is in line with the onshore oil production volume for 2022. These volumes represent a drop of 11% compared to both 2021 and 2020, when the onshore oil production reached 0.09 million bpd. In 2023, offshore oil production reached the most significant volume ever recorded since the beginning of the historical series in 2014. Ever since, production has been on the rise.

Open Acreage Offering: ANP approves Strategic Calendar for Geological and Economic Assessment

On July 11, 2024, the ANP’s Board approved the Strategic Calendar for Geological and Economic Assessment regarding the 2024-2025 Open Acreage Offering (“OPC”).

Publishing the calendar can help reduce geoscientific and operational risks, market volatility, and variations in demand relating to oil and gas exploration and production.

According to the ANP, the objective of this measure is to foster transparency and predictability so that the market can direct future investments with greater assertiveness. As for 2024, the study will prioritize the remaining areas of the Pelotas and Santos basins. As for 2025, some of the privileged basins are those located in the Equatorial margin.

4th Federal Oil Auction lots are auctioned

On July 31, 2024, the 4th Federal Oil Auction was held, offering approximately 37.5 million barrels of oil, referring to the Federal Government’s estimated production for 2025 from the Mero and Búzios Fields.

According to reports, in the first lot, which included 12 million barrels, Petrobras was the winner with a bid of USD 1.85 discount on the price of the dated brent. As for the second lot (12 million), CNOOC Petroleum was the winner, offering a discount of USD 1.59 per barrel. The last Mero lot (11 million) went to PetroChina for USD 1.35 lower than the dated Brent barrel.

As highlighted by the interim president of PPSA, the Federal Government’s 4th Oil Auction reached the highest value ever attributed to the Federal Government’s oil in history.

POWER

HIGHLIGHTS

Distributed Generation: TCU orders ANEEL to submit an inspection plan for “energy by subscription”

In early 2024, a representation was filed with the Brazilian Federal Court of Accounts (“TCU”) to investigate omissions of the National Electric Energy Agency (“ANEEL”) regarding alleged indications of trading of electricity credits within the scope of distributed generation – which is forbidden, according to Art. 28 of Law No. 14,300/2022.

ANEEL had undertaken to improve the regulation to address the problem and to submit a plan for monitoring these activities.

TCU’s Justices partially approved the representation and determined that ANEEL:

- Submit, within 60 days, an action plan to improve the inspection and regulation on this matter; and

- Conclude, within 90 days, Call for Contributions (“TS”) No. 18/2023, on regulatory measures to mitigate energy trading mechanisms within the scope of the Electricity Compensation System.

TCU’s decision raised questions within the sector about potential excesses in its determinations, whether the TCU has the power to interfere with the regulator’s operation, and whether the agency has the power to impose measures to invalidate the consolidated legal system and legal transactions that had already been fine-tuned.

Entities integrating the power sector have requested admission in the proceeding as amicus curiae and argue that the model currently adopted is legal, promotes the popularization of photovoltaic sources within the country, and further allows for the democratization of renewable energy sources by consumers, through shared generation exploration.

Whatever measure ANEEL adopts in order to comply with TCU’s decision, legal certainty must be observed.

Access the representation in full.

Distributed Generation: New regulation on reverse power flow

Normative Resolution (“REN”) ANEEL No. 1,098/2024 – published recently – addresses the reverse power flow in cases involving the connection of distributed micro or mini-generation.

The reverse power flow occurs when the amount of electricity produced by distributed generation systems exceeds the demand of consumers connected to the same distribution grid, which could cause overload, voltage imbalance, and electricity supply interruptions.

Article 73, §1, of REN No. 1,000/2021 established that in the event of a new connection or increased injected power of distributed micro or mini-generation, the distribution company should conduct studies to identify feasible options to eliminate such reverse power flow.

The market had been waiting for clearer rules on the subject in view of the occurrence of several cases in which connection requests from distributed generation units were rejected by the distribution companies on the basis of the generic application of Art. 73.

As a result, new REN No. 1,098/2024:

- Establishes the drafting of the “Instruction Manual for Reverse Power Flow Study”, to standardize and detail the studies carried out by the distribution company;

- Determines that the reverse power flow analysis should disregard the flow in the exclusive use transformer, in relation to distributed generation consumer units classified under Group B; and

- Defines the events for waiving the reverse power flow study, such as (i) units eligible for free grid connection; (ii) units that do not inject power into the network; (iii) local self-consumption units with an installed power of up to 7.5 kV.

Read Normative Resolution No. 1098/2024 in full.

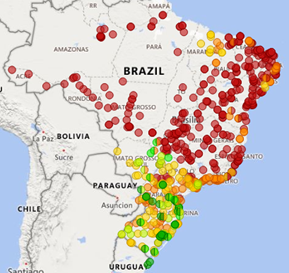

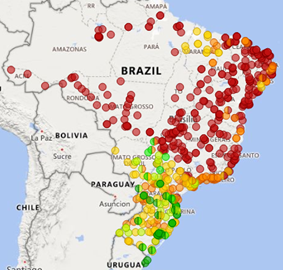

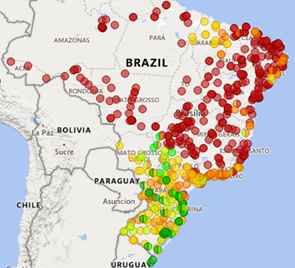

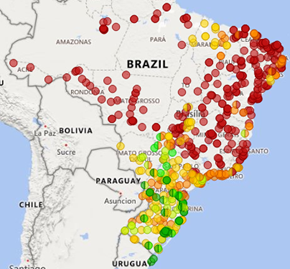

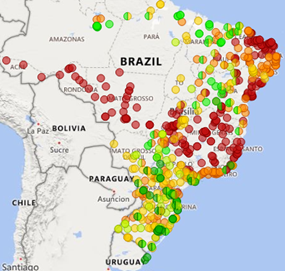

Map of remaining power flow margin within transmission system

REN ANEEL No. 1,069/2023 determines that the National Electric System Operator (“ONS”) should provide a map displaying the transmission system’s remaining power flow margin. The map was made available on July 31, 2024, introducing data on the 2025-2029 period.

The map shows progress regarding remaining capacity and generation amounts, including an ongoing, valid, or executed Transmission System Use Agreement (“CUST”). Conversely, such map does not include generation projects that have joined the exceptional mechanism for addressing grants and hiring additional margin, as provided for in REN No. 1,065/2023.

The map will assist agents in decisions involving connection sites. The data provided replaces the previous “Access Information” formerly required by the agents. However, such data does not prevent the need to request access to the ONS when applying for the grant, whose access opinion can include more detailed assessments of the power plant’s connection and even data not displayed on the map.

By visualizing the map, it is possible to identify, for each year, the regions where the generation flow capacities are higher – highlighted in red – as shown below:

2025 Scenario |

2026 Scenario |

2027 Scenario |

2028/2029 Scenario |

Post-2029 Scenario

NEWS

New regulations for wind farm measurements

The Ministry of Mines and Energy (“MME”) published Ordinance No. 797/GM/MME/2024, establishing a new deadline for the start of permanent anemometric and climatological wind measurements at generation park sites. These measurements must take place within 60 days from the start date of the power plant’s construction works.

Previously, the deadline was 180 days from execution of the Electricity Trading Contracts in the Regulated Environment (“CCEAR”) or the Reserve Energy Contract (“CER”).

Access the ordinance in full.

Battery R&D call report

On July 05, 2024, ANEEL published the report with the result of Call No. 21/2016 of the Research, Development, and Innovation Program (“PDI”), entitled “Technical and Commercial Agreements for Including Energy Storage Systems in the Brazilian Electricity Sector”.

Call No. 21/2016 assesses the inclusion of energy storage systems within the Brazilian electricity sector. Twenty projects have been completed, with investments accounting for more than BRL 300 million. Among these projects, it is worth highlighting the construction of smart microgrids, dispatch optimization algorithms, battery life management, studies on the possibility of reusing batteries, provision of ancillary voltage adjustments, and frequency control services.

International cases have demonstrated the progress and development of energy storage systems. Brazil’s delay in regulating this matter hinders the development of this technology across the country.

Batteries were expected to be included in the 2024 auction for power reserve capacity. However, this was not carried out due to the need for a regulatory basis.

Even though further aspects are needed, industry agents are eager to use the new technology.

Ten-year Energy Expansion Plan – 2034

The third booklet of the Ten-Year Energy Expansion Plan – 2034, published on July 15, 2024, establishes the Power Generation Requirements for Meeting the Power Supply Criteria.

The analysis shows that the National Interconnected System (“SIN”) requires an additional power supply from 2027 and an additional electricity supply from 2028.

Renewables and other Energy Sources

ANP authorizes the trading of maritime fuel with added biodiesel

On July 11, 2024, the ANP’s Board authorized trading maritime fuel oil with 24% biodiesel, which Petrobras had previously requested. This is the first authorization granted by the ANP for the ongoing bunker trading with renewable content to be used in vessels.

Petrobras carried out several tests on ships using maritime fuel oil with added biodiesel, ranging from 10% to 24%. In the last test, using 24% biodiesel, not only did it confirm that there were no problems, but it also showed a 19% reduction in greenhouse gas emissions compared to fuel with no renewable content. This measure aligns with the strategy adopted in 2023 by the member states of the International Maritime Organization (IMO), including Brazil, which aims to zero net greenhouse gas emissions from maritime transport by 2050.

From this perspective, in 2024,the International Organization for Standardization included a permission for the use of 100% biodiesel on ships, in compliance with ISO 8217, “Products from Petroleum, synthetic and renewable – Fuels (class F) – Specifications of Marine Fuels”.

Thus, given the positive results from the tests carried out, the ANP’s Board also indicated that it will review ANP Resolution No. 903/2022 as a measure for the next cycle of the ANP’s regulatory agenda.

Clean Energy Program is incorporated into Minha Casa, Minha Vida

On July 01, 2024, Decree No. 12,084/2024 – which incorporates the Clean Energy Program into the Minha Casa, Minha Vida Program – was published, aiming to foster the implementation of renewable energy generation in the housing units of the Minha Casa, Minha Vida Program, corresponding to Urban Zone 1, Urban Zone 2 and Rural Zone 1, classified as “Low-income Residential Subclass”.

On July 23, 2024, ANEEL’s board of directors approved changes to REN No. 1,000/2021 to regulate the matter and establish parameters for distribution companies to carry out infrastructure works involving the grid and the project’s internal electrical facilities.

Such measures will allow for the reduction of energy invoices of consumers who are eligible for the program. In addition, the Ministry of Cities and the MME will collaborate to define the technologies of the generating plants integrating the program.

Access ANEEL’s article in full.

CME approves bill on the disposal of photovoltaic panels

On July 03, 2024, the Mines and Energy Committee (“CME”) approved Bill No. 998/2024, which establishes the Policy to Incentivize the Development of Reverse Logistics for Photovoltaic Panels, seeking to boost research, technological innovation, and the implementation of processes for the reuse, recycling, and environmentally appropriate final disposal of its components, thus ensuring environmental sustainability while expanding renewable electricity generation from solar energy sources.

For this purpose, funds and credit lines will be made available for researching and implementing such policy, its certification systems, fiscal and tax incentives, and the experimental regulatory environment.

Bill No. 998/2024 is paramount, considering that Brazil has more than 14 million kilowatts of power granted from photovoltaic plants in operation. Therefore, although this technology drives the energy transition sought, it is worth highlighting the importance of appropriately addressing the disposal (and potential recycling) of photovoltaic panels.

As for the next steps, Bill No. 998/2024 will seek the Urban Development Commission’s analysis.

NEWS

South America’s wind capacity will rise by 100% in the next decade

On July 09, 2024, according to Wood Mackenzie’s study “Prospects for onshore wind energy in South America”, the continent’s accumulated wind capacity will double to 79 GW in the next ten years.

Brazil will continue to be the region’s largest market and contribute 54% of South America’s total growth in wind generation, providing an additional 21.5 GW by 2033. Brazil is followed by Chile (6.2 GW) and Argentina (4.5 GW).

The study showed that limited transmission infrastructure will continue to be an obstacle to developing onshore wind power in the region. In addition, such infrastructure will also face fierce competition from cheap solar photovoltaic energy, which benefits from dispersed sites to overcome essential grid upgrades that are still pending conclusion.

Solar energy exceeds 44 GW in Brazil

On July 18, 2024, according to Absolar, the solar source exceeded 44 GW of installed power. According to the entity, the photovoltaic sector has attracted more than BRL 208.2 billion in investments and generated more than 1.3 million local jobs. In this regard, in 2024, the solar source added 7GW to the national electricity matrix, adding large solar power plants and self-generation systems on roofs, facades, and the ground, which significantly expands Brazil’s lead in the global energy transition.

The ONS set eight solar generation records in 2024 – six in the Northeastern subsystem and two in the National Interconnected System (“SIN”). In addition, self-generation exceeded 30GW of installed solar power, representing approximately BRL 146.7 billion in investments and 902,000 green jobs created. The centralized generation segment, corresponding to 14 GW of power, has accumulated investments of approximately BRL 61.5 billion and has generated more than 429,800 green jobs since 2012.

ANAC regulates the monitoring and offsetting of CO2 emissions for international flights

On July 12, 2024, Ordinance No. 15,007/SRA/2024 was published, which establishes the process of monitoring and offsetting carbon dioxide (CO2) emissions for international operations under the Carbon Offsetting and Reduction Scheme for International Civil Aviation (“CORSIA”).

In May 2024, the National Civil Aviation Agency (“ANAC”) had already regulated the monitoring and offsetting of CO2 emissions, thus allowing Brazil to submit the results regarding offsetting CO2 in the national airspace to the International Civil Aviation Organization.

The ordinance details the assessment for reaching the amount of emissions, the process for reporting and verifying those, as well as offsetting and monitoring activities.

It is worth highlighting that CORSIA is a global aviation industry agreement for carbon-neutral growth. This means that, despite the increase in air travel, the sector seeks to stabilize its emissions. As of 2027, the mechanism will be mandatory for all signatory countries, including Brazil.

In order to comply with the agreement, airlines are investing in more efficient aircraft and new fuel types. In markets where offsetting is already mandatory, airlines also acquire carbon credits to offset the carbon emitted by fossil kerosene.

Brazil establishes a partnership with ITA toward industrial decarbonization

On July 17, 2024, the Ministry of Development, Industry, Commerce, and Services (“MDIC”) announced a partnership with the Industrial Transition Accelerator (ITA), whose objective is to develop industrial decarbonization projects, seeking to achieve final investment decisions until COP30 is held.

ITA is a global initiative aiming to advance decarbonization in the industrial and transportation sectors, which account for high CO2 emissions. ITA is financed by Bloomberg Philanthropies and the United Arab Emirates.

The initiative will assist in improving Brazil’s green industrial project portfolios and will further collaborate with Brazil’s Climate Transition Platform, which is being developed by both the Brazilian National Bank for Economic and Social Development (“BNDES”) and the Glasgow Financial Alliance for Net Zero, to finance projects in line with the government’s energy transition plans.

In order to identify key challenges, developers must submit the main obstacles to project progress. These contributions aim to identify projects in high-emission sectors with the potential for large-scale deep decarbonization using innovative technologies close to commercial maturity. Contributions can be sent by September. The partnership established between ITA and MDIC will further strengthen Brazil’s sustainable agenda.

OPPORTUNITIES

| TYPE | DESCRIPTION | CONTRIBUTION PERIOD | CODE / NOTES |

| Petrobras Contracting | Chartering and Operation Services of FPSO – Barracuda and Caratinga Revit | August 30, 2024

12:00 PM |

7004050042 |

| Petrobras Contracting | Chartering up to 12 PSV vessels – Platform Supply Vessel, of Brazilian Flag. | September 13, 2024

05:00 PM |

7004265988 |

| Petrobras Contracting | Chartering of helicopters to assist Petrobras, regarding LOTS A, B, C, D, E, F, G, and H | August 20, 2024

05:00 PM |

7004267235 |

| Petrobras Contracting | Chartering of helicopters to assist Petrobras, regarding LOTS A, B, C, D, E, F, G, and H | August 16, 2024

12:00 PM |

7004267238 |

| Petrobras Contracting | EPC HIDW AND HCC GASLUB | October 21, 2024

12:00 PM |

7004269219 |

| Petrobras Contracting | EPC HDT, UTAA and UTCR GASLUB | October 21, 2024

12:00 PM |

7004269577 |

| Petrobras Contracting | EPC UGH GASLUB | October 21, 2024

12:00 PM |

7004269429 |

| Petrobras Contracting | EPC URE, MDEA, AMMONIA, AND TAIL GAS GASLUB | October 21, 2024

12:00 PM |

7004269503 |

| Petrobras Contracting | Chartering of large Helicopters for the Equator Margin Campaign – LOT H | August 06, 2024

12:00 PM |

7004267355 |

| Petrobras Contracting | Chartering of helicopters to assist Petrobras – LOTS K and L | August 19, 2024

12:00 PM |

7004267356 |

| Petrobras Contracting | Chartering of helicopters to assist Petrobras Pool – LOT N | August 23, 2024

12:00 PM |

7004267359 |

| Petrobras Contracting | Contracting charter for time up to two self-elevating and self-propelled vessels | August 19, 2024

12:00 PM |

7004277659 |

| Petrobras Contracting | Chartering up to seven vessels | August 20, 2024

05:00 PM |

7004289587 |

| Petrobras Contracting | OSRV – Chartering of up to six vessels | August 15, 2024

05:00 PM |

7004294410 |

| Petrobras Contracting | Chartering up to four vessels | August 13, 2024

12:00 PM |

7004288356 |

| Petrobras Contracting | Chartering of five LH 2500 vessels | August 08, 2024

05:00 PM |

7004289829 |

| Petrobras Contracting | EPCS for completion of the remainder | September 04, 2024

12:00 PM |

7004278431 |

| Petrobras Contracting | Provision of Technical Services for Repairing Modules and Plates,

Specialized Technical Support Services and Specialized Technical Visit in PABX telephone systems |

August 12, 2024

08:00 PM |

7004281741 |

| Petrobras Contracting | Multimedia telecommunications services | August 14, 2024

05:00 PM |

7004293845 |

| Call for Contributions (ANEEL) | Definition of the regulatory matters and actions necessary for modernizing distribution tariffs – roadmap.

|

From June 28, 2024, to September 26, 2024 | |

| Public Consultations (ANEEL) | Obtain contributions to improve the notice and annexes of Existing Energy Auctions No. 3/2024-ANEEL, No. 4/2024-ANEEL, and No. 5/2024-ANEEL (Existing Energy Auctions “LEEs” “A-1” and “A-3”, of 2024), aimed at contracting electricity from existing generation projects. | From July 17, 2024, to September 02, 2024 |

** Please note that the deadlines in the table above are constantly changing and correspond to the deadlines disclosed at the time of publication of this newsletter.

WHATS COMING UP

|

August/2024 – New Energy Auctions “A-4” and “A-6”

To be held by ANEEL. |

|

September/2024 – Transmission Auction 002/2024

To be held by ANEEL. |

|

October/2024 – Auction for the Supply of Isolated Systems

To be held by ANEEL. |

|

November/2024 – Auction for Contracting Capacity Reserve

To be held by ANEEL. |

|

December/2024 – Existing Energy Auctions “A-1” and “A-2″

To be held by ANEEL. |

|

July/2025 – Auction for Contracting Capacity Reserve

To be held by ANEEL. |

|

March/2025 – Transmission Auction 001/2025

To be held by ANEEL. |

|

August/2025 – New Energy Auctions “A-4” and “A-6”

To be held by ANEEL. |

|

September/2025 – Transmission Auction 002/2025

To be held by ANEEL. |

|

October/2025 – Auction for the Supply of Isolated Systems

To be held by ANEEL. |

|

November/2025 – Auction for Contracting Capacity Reserve

To be held by ANEEL. |

|

December/2025 – Existing Energy Auctions “A-1” and “A-2″

To be held by ANEEL. |

|

March/2026 – Transmission Auction 001/2026

To be held by ANEEL. |

|

September/2026 – Transmission Auction 002/2026

To be held by ANEEL. |

Related Partners

Related Lawyers

Arthur Azerêdo Alencar Feitosa

Bianca Reis

João Raphael Oliveira Aranha

Laura Isabelle Guzzo

Lívia Sousa Borges Leal

Luis Eduardo Ribeiro

Roberta Coelho de Souza Batalha

Thais Araujo Rato Tarelho

Related Areas

Oil and Gas Energy and Natural Resources